Beginning for tax year 2020, business taxpayers must report nonemployee compensation using the 1099-NEC Form. Prior to 2020, payers completed form 1099-MISC to report nonemployee compensation of $600 or more in box 7. Form 1099-MISC has been redesigned and no longer includes employee compensation. Instead, the IRS reintroduced form 1099-NEC to simplify the deadline among other things.

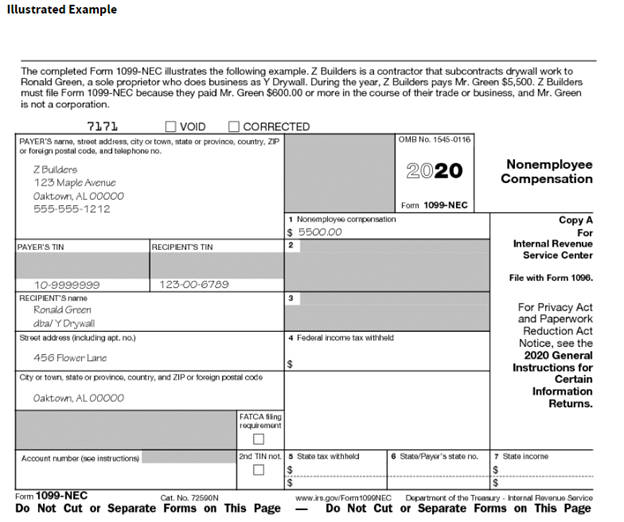

The 1099-NEC Form shown at right reports the payments made to non-employees on box 1.

Who must file Form 1099-NEC?

If the following four conditions are met, you must generally report a payment as NEC.

- You made the payment to someone who is not your employee.

- You made the payment for services in the course of your trade or business (including government agencies and nonprofit organizations).

- You made the payment to an individual, partnership, estate, or, in some cases, a corporation.

- You made payments to the payee of at least $600 during the year

If any amount of money was withheld for federal or state taxes, Form 1099-NEC must be filed.

Use Form 1099-NEC to report nonemployee compensation of $600 or more including

- Fees

- Commissions

- Prizes and Awards

- Other forms of compensation for services

- Fish purchases for cash

When is Form 1099-NEC due?

1099-NEC forms must generally be distributed and/or postmarked to recipients and the IRS by January 31. Since January 31 falls on a Sunday for the 2021 year, the 2020 forms are due the following day February 1.

There is no automatic 30-day extension to file form 1099-NEC. However, certain taxpayers may request one for specific limited reasons.

When do I have to file form 1099-MISC?

From 1099-MISC is still required for some business taxpayers. The major redesign in the form included shifting nonemployee compensation in box 7 to form 1099-NEC. Instead Box 7, shows if the payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale.

Business taxpayers should report payments made of $600 or more including

- Royalties ($10 amount or more needs to be reported)

- Rents

- Other Income

- Fishing boat proceeds

- Medical and healthcare payments

- Crop insurance proceeds

- Payments to an attorney

- Section 409A deferrals

- Nonqualified deferred compensation