Estimated Tax Payments

We all have to pay income taxes, and for most people income taxes are withheld from paychecks. This is because the U.S. tax system works on a pay-taxes-as-you-earn basis. This is a great way to pay for workers who receive a W-2, but how about the income that is not subject to withholding tax? This can include income from self-employment, business earnings, interest, rents, dividends and other sources. If the U.S treasury doesn’t get their share close to the time you received the money, you could end up owing not only taxes but also penalties and interest. To keep this from happening you have to get the money to the government yourself by filing estimated tax payments. For most small businesses it is the owner not the business that is required to make estimated tax payments. That’s because most small business entities, such as LLCs, are pass-through entities for tax purposes. If you expect to owe $1,000 or more in taxes, then you must pay estimated taxes on income.

When do you pay?

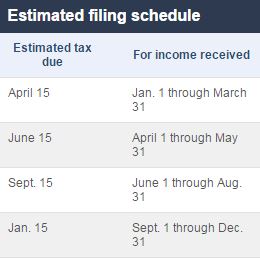

The IRS requires estimated tax to be paid quarterly, typically in 4 equal installments. For the purpose of estimated tax, the year is divided into 4 payment periods. Each period has a specific payment deadline, and failing to pay on time can result in IRS penalties.

You can send a paper check along with the 1040-ES voucher, and most conveniently you can file electronically with a credit card, by enrolling in the tax agency’s electronic payment system, or by using the IRS Direct Pay option.

What do you pay?

So how much do you sent every quarter? How do you estimate for the coming three months, and what if your estimate is off?

To calculate your estimated tax, you need your expected income, taxes paid to date, deductions, and potential credits for the year. If available, using last year’s amounts for these will help. If you are a new business and your records are up to date this should not be too painful. If you need help with this process, we are happy to help.

As long as you pay at least 90% of the tax for the current year, or 100% of the tax you owed for the prior year, whichever is smaller you should not have to pay a penalty. This is helpful for people who have a supplemental business income and a full time job that provides a W-2. If 90% of your income tax is withheld by your employer, you may not need to pay estimated tax on the supplemental income.

Keep in mind that many states also may require estimated tax payment and each has different requirements. For Illinois if you expect your tax liability to be more that $500 you need to make estimated payments quarterly.

Final Thoughts

While the 90% gives you some room, completing the calculation correctly can be challenging. Always consult a tax professional to make sure you have determined the correct estimated tax payments to avoid additional fees.