Note: This guidance was sent as a client alert on April 6, 2020 and the information is current as of that date.

Paycheck Protection Program Loans

Applications for the Paycheck Protection Program (PPP) Loans were available from a small number of banks on Friday, April 3rd. Many banks are still working to provide applications to clients and interpret the legislation and guidance released to date. We know many of you are concerned about the availability of funds and want to ensure that you obtain needed capital as soon as possible. Some bankers and other observers were predicting the funding cap would be reached very quickly. Senator Rubio, who is the Chairman of the Senate Committee on Small Business and Entrepreneurship announced that he expected the PPP Loan funds currently allocated to last until early June. He also indicated that if money ran out prior to the end of the program, Congress should consider adding additional funds. The White House has also indicated that they would recommend an additional allocation if the funding cap is reached. There are still issues to be worked out with the program, but the application issues with most banks are expected to be available later this week.

Still to be resolved are disagreements on the basics of the program, like what is included in payroll costs. Our firm currently recommends that for the calculation of the average monthly payroll cost, applicants should use gross payroll (including tax expenses) — based on 2019 data — for the PPP loan application and forgiveness. Neither the CARES Act itself nor the guidance the Small Business Administration (SBA) released Thursday evening specifically stated that payroll taxes should be excluded from the calculation. Additionally, based upon statements from members of Congress, it appears that the intent of the Act was to base the salary calculation on gross payroll with no adjustment for federal taxes. This position is also consistent with the position currently recommended by the AICPA.

We expect most of our business clients to qualify for this program. If you haven’t reviewed the program yet, we suggest doing so at your earliest opportunity. You can find more information in our COVID-19 Resource Center.

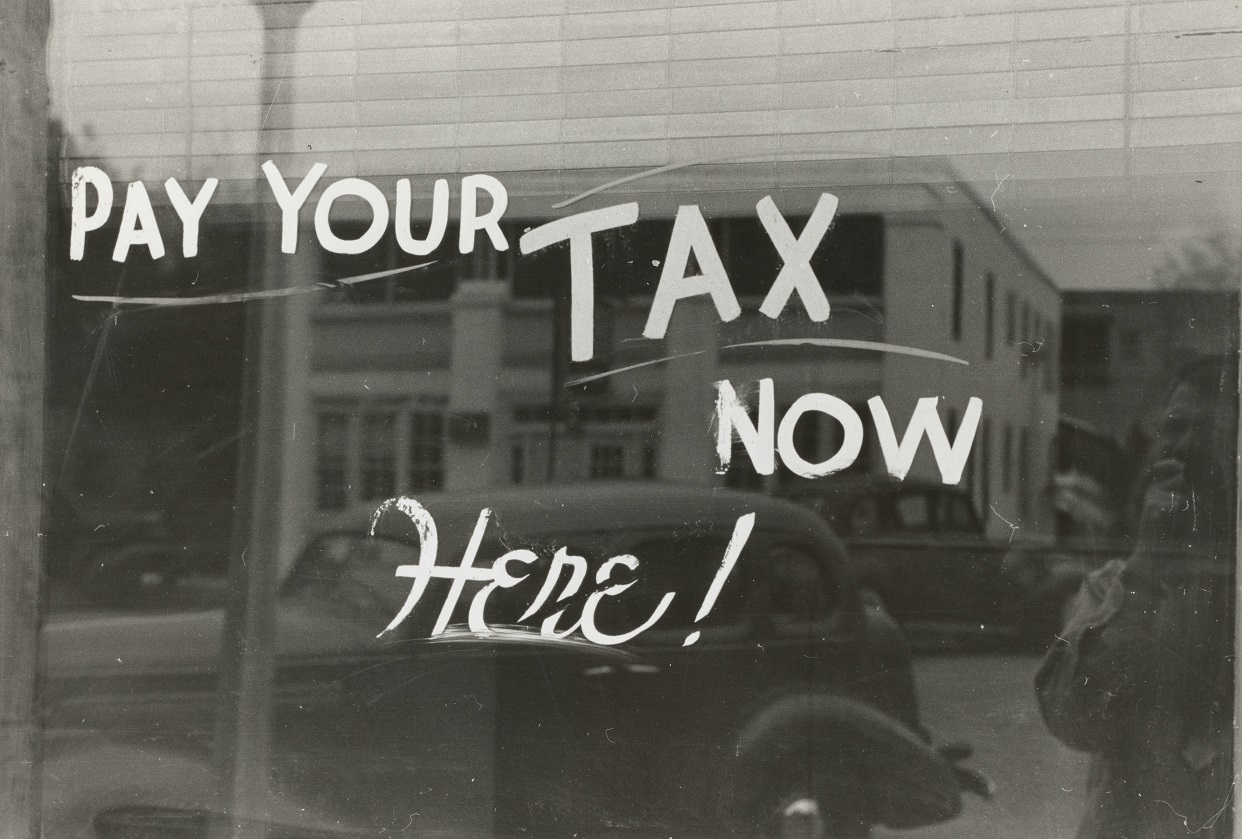

Estimated Tax Payments

On Thursday, April 2, the Illinois Department of Revenue (IDOR) announced an additional option for estimated payments that are due on April 15th. With the federal estimated tax payments delayed until July 15th, we have been awaiting a statement from the department for estimated payment deferral or simplification. The IDOR has made clear that estimated payment filings for first and second quarter will not be extended due to the state’s financial situation and expenditures necessary to respond to COVID-19. The IDOR solution is a simplified process for making the 2020 estimated payments. The actual tax liability from the 2018 tax year can be used to calculate the 2020 estimated payment. The total tax liability in 2018 should be divided into four equal (25%) payments. The first quarter estimated payment is still due April 15th. While we recognize this is not the relief many people were hoping for, it does provide simplification for payment calculation and compliance. IDOR Informational Bulletin 2020-26

Have questions? Need more information? Schedule a free consultation today!