This post will focus on the entries to be booked when your business receives the PPP loan disbursement and expense tracking of those funds. All instructions and screenshots use QuickBooks Online (QBO). If you use a different accounting software, you will need to modify accordingly.

PPP Loan Disbursement Setup

Setup a Sub-Bank Account for PPP Loan Funds

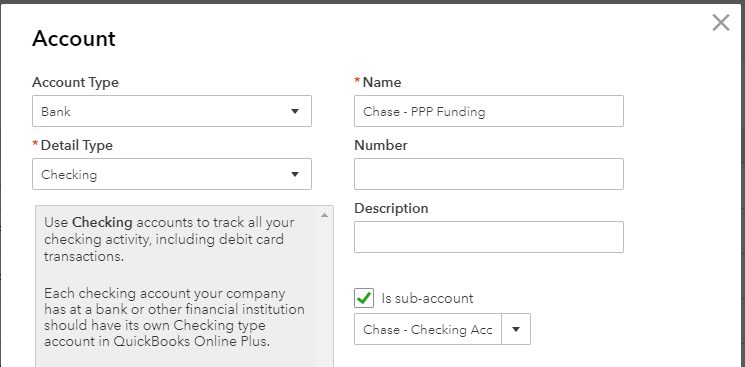

We suggest creating a new sub-bank account in the chart of accounts for the checking account that receives the funds. This separation will not impact regular procedures, like bank reconciliations, but will allow for a clean audit trail. To be clear, this is not an actual new bank account, just a proforma account for tracking purposes.

To setup the new sub-account in QBO: Gear Icon | Chart of Accounts | New | Account Type: Bank Account | Detail Type: Checking

Setup a Liability Account for PPP Loan Funds

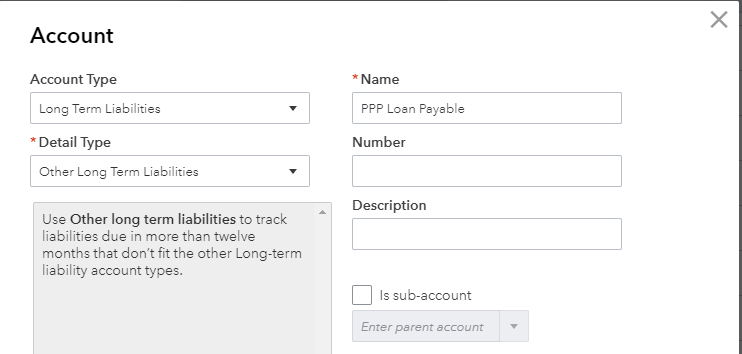

Until forgiveness is determined, these funds are a loan and should be recorded as a liability. A new account, “PPP Loan Payable”, should be created on the chart of accounts.

Client circumstances will dictate whether the loan will be recorded as an “Other Current Liability” or “Long Term Liability”. We expect most clients to record the loan proceeds as long term.

To setup the new sub-account in QBO: Gear Icon | Chart of Accounts | New | Account Type: Other Current Liability OR Long-Term Liability | Detail Type: Loan Payable OR Other Long Term Liabilities

Record the PPP Loan Disbursement

- Setup Loan Vendor

- Verify that the bank disbursing your loan funds is setup as a vendor. If this institution is a new vendor, you will need to setup the vendor.

- To setup the new vendor in QBO: Expenses | Vendors | New Vendor

- Record Deposit

- You can book the deposit manually in the bank account and match it when it appears on the bank feed or you can wait for it to appear on the feed and categorize it directly. When you enter the transaction, you should ensure that the vendor and liability account created previous are used and include a memo of “Receipt of PPP funds”.

- Transfer funds to the new sub-bank account

- To transfer the funds in QBO: + New | Transfer |

- Date: Date funds were received

- From: Account receiving funds

- To: Newly created sub-bank account

- Amount: PPP loan proceeds

- To transfer the funds in QBO: + New | Transfer |

Record Eligible PPP Expenses

Expenditures should be recorded to the usual categories in QBO, but the funds should be disbursed from the newly created sub-account. This will provide you with a clearly separated ledger to show all expenses that were paid for using PPP loan proceeds.

If your expenses are combined and include non-allowable expenses, like payments to contractors paid via payroll, you will have to book adjustments from your regular checking account to the newly created sub-bank account. You can book these as transfers from the regular bank account to the sub-account and label them as “reimbursement for non-allowable PPP expenses”. This will ensure that you have a detailed audit trail when you apply for forgiveness.

PPP Eligible Expenses

- According to the Treasury Department, eligible uses of loan proceeds are:

- Payroll costs, including benefits

- Interest on mortgage obligations, incurred before February 15, 2020

- Rent, under lease agreements in force before February 15, 2020; and

- Utilities, for which service began before February 15, 2020.

- What qualifies as payroll costs?

- Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for each employee)

- Employee benefits including costs for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; and payment of any retirement benefit

- State and local taxes assessed on compensation; and

- For a sole proprietor or independent contractor with employees: wages, commissions, income, or net earnings from self-employment, capped at $100,000 on an annualized basis for each employee.

- For a sole proprietor or independent contractor without employees: The amount of “owner compensation replacement” you’re eligible to claim for forgiveness is calculated by multiplying your reported net income in 2019 on your Schedule C by 8/52 (or 0.154)

Rapidly Evolving Guidance

This information is current as of the time of publication. The SBA and Treasury department continue to release additional guidance and we will continue to post additional resources and analysis as more information becomes available.

Have questions? Need more information? Schedule a free consultation today!