***This blog has been updated on December 21, 2017 to reflect the tax bill passed by Congress***

In the past month, the House and Senate have both voted along party lines to approve their own versions of comprehensive tax reform legislation. In order to gather the necessary votes to pass their respective chambers, Republican leaders made some significant modifications during the process. In a series of blog posts, we will cover the major pieces of both bills and compare them to current law. You can see all tax reform 2017 related blogs here.

This blog will cover the topic of C Corporation income tax rates. The changes included in both bills will require businesses to consider accelerating deductions and deferring taxable income prior to the rate reduction. The key difference between the House and Senate versions is the one-year delay of the rate reduction in the Senate bill. This should be considered during any planning discussions.

CONFERENCE COMMITTEE APPROVED BILL

The C Corporation income tax rates would be lowered to a flat 21% rate (the special tax rate for personal services corporations would be eliminated) for tax years beginning after December 31, 2018.

CURRENT LAW

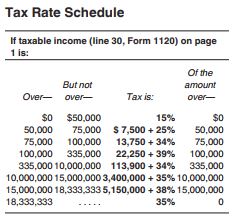

Under current law, C Corporations are taxed on the following graduated schedule:

A qualified personal service corporation is taxed at a flat rate of 35% on taxable income.

HOUSE TAX REFORM BILL

The C Corporation income tax rates would be lowered to a flat 20% rate (the special tax rate for personal services corporations would be reduced to a flat 25% rate) for tax years beginning after December 31, 2017.

The legislation preserves the current tax rates on dividend income by reducing the dividends-received deduction to 65% and 50% (from 80% and 70%, respectively).

SENATE TAX REFORM BILL

The C Corporation income tax rates would be lowered to a flat 20% rate (the special tax rate for personal services corporations would be eliminated) for tax years beginning after December 31, 2018.

The legislation preserves the current tax rates on dividend income by reducing the dividends-received deduction to 65% and 50% (from 80% and 70%, respectively).